How to Roll Out Effective Company Frameworks in a Hospital

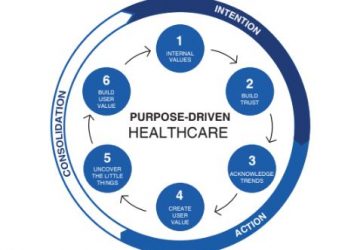

A hospital’s company-wide frameworks act as significant indicators of its priorities. They are a set of actions or procedures that everyone must follow in the same way. Effective company-wide frameworks ensure that all hospital operations… Read more